Unlock Expert UK Accounting

Trusted By

Why DIY Tax Filing Keeps

Destroying UK Businesses

HMRC Penalties Pile Up Fast

One late filing triggers automatic £100-£500 penalties. Multiple violations lead to investigations costing £10K-£50K in legal fees, frozen accounts, and director disqualification threats.

Missing Tax Reliefs = Lost Money

Without expert guidance, businesses leave £15,000-£100,000 on the table annually through unclaimed R&D credits, capital allowances, and tax-efficient structures HMRC won't tell you about.

Cash Flow Chaos & Blind Growth

You can't scale what you can't measure. Poor bookkeeping means zero visibility on profit margins, cash runway, or where money actually goes—leading to terrible business decisions.

They Always Side With the Buyer

Cheap platforms like Stripe automatically refund clients without investigation, leaving you to absorb the loss. One dispute wave can wipe out months of profit with zero recourse.

Compliance Errors Kill Credibility

Companies House strikes, incorrect VAT registration, payroll mistakes—each error damages your credit rating, blocks business loans, and signals "high risk" to investors and banks.

Banks & Investors Walk Away

Poor quality accounts = immediate rejection. Banks deny loans, VCs lose confidence, and growth opportunities vanish because your financials don't meet professional standards.

Our Impacts

Serving 2,000+ Businesses Across the UAE

Smart UK Entrepreneurs Don't Gamble with HMRC. They Choose Insider-Backed Accounting Built for Unlimited Growth.

Escape penalties, frozen funds, and compliance nightmares—unlock a UK accounting setup engineered by tax specialists for guaranteed stability

Insider-Backed UK Setup

Access to UK tax specialists with deep HMRC relationships who know every loophole, relief, and optimization strategy most accountants miss

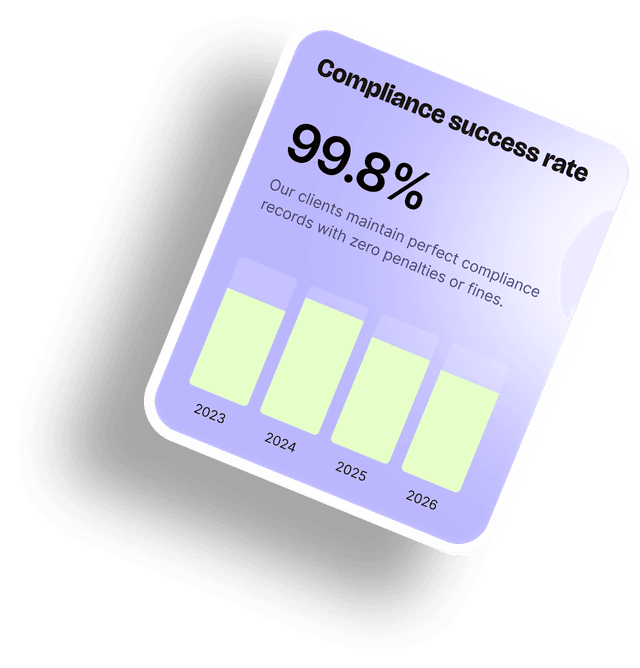

100% HMRC Compliance

Every filing deadline met automatically—Corporation Tax, VAT, Self Assessment, payroll submissions. Zero penalties, zero stress

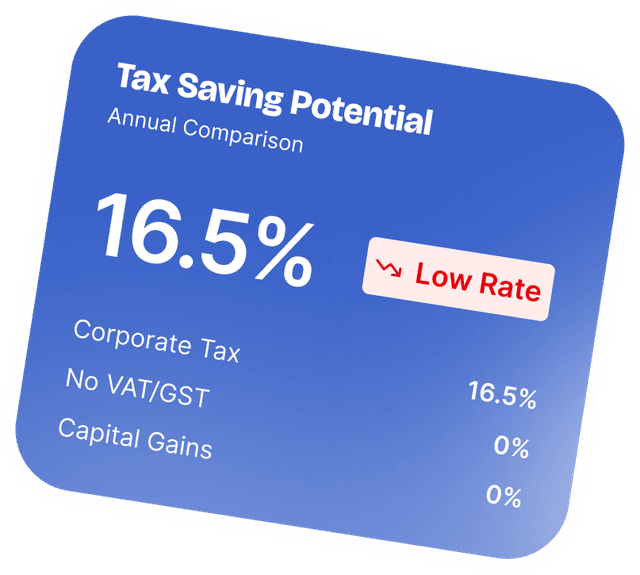

Tax Optimization Built-In

We identify every available relief, credit, and allowance. Typical clients save £15,000-£50,000 annually through strategic planning

Dedicated UK Accountant

Your own qualified accountant team who knows your business inside-out. Direct phone/email access whenever needed

Real-Time Financial Dashboard

See profit, cash flow, and tax liability instantly. Make data-driven decisions backed by accurate, up-to-date financials

Fast Company Formation

Register UK Limited Company in 24-48 hours. Includes registered office, company secretary, all incorporation docs

Investor-Grade Financials

Bank-approved accounts that unlock funding. We ensure your financials meet standards lenders and VCs demand

Unlimited Support Access

Real accountants respond fast—no offshore call centers, no chatbots. Just expert UK-based support when you need it

We Take You From Zero to a Fully

Activated UK Accounting Setup

A UK accounting setup is complex... regulations, compliance docs, and hidden requirements most entrepreneurs miss. We handle everything.

Free

Strategy Call

Book a discovery session with our UK accounting specialists. We analyze your situation, identify tax optimization opportunities, and design your perfect setup—zero pressure, pure value.

UK Company

Formation

We register your UK Limited Company with Companies House, secure registered office address, appoint company secretary, and deliver all incorporation certificates within 2 days.

Banking & HMRC Registration

We handle UK business bank account setup with our partners, register you for Corporation Tax, VAT (if applicable), and PAYE schemes—everything fully activated and compliant.

Accounting System Integration

We connect your bank feeds, integrate invoicing software, set up cloud accounting platform (Xero/QuickBooks), and sync everything for real-time financial visibility.

Tax Planning & Optimization Setup

We identify all available tax reliefs, set up profit extraction strategies, configure payroll if needed, and create your customized tax roadmap for maximum savings.

Mission Accomplished!

Your UK Accounting Empire is Active. Now You Have Access To:

Free

Strategy Call

Book a discovery session with our UK accounting specialists. We analyze your situation, identify tax optimization opportunities, and design your perfect setup—zero pressure, pure value.

UK Company

Formation

We register your UK Limited Company with Companies House, secure registered office address, appoint company secretary, and deliver all incorporation certificates within 2 days.

Banking & HMRC Registration

We handle UK business bank account setup with our partners, register you for Corporation Tax, VAT (if applicable), and PAYE schemes—everything fully activated and compliant.

Accounting System Integration

We connect your bank feeds, integrate invoicing software, set up cloud accounting platform (Xero/QuickBooks), and sync everything for real-time financial visibility.

Tax Planning & Optimization Setup

We identify all available tax reliefs, set up profit extraction strategies, configure payroll if needed, and create your customized tax roadmap for maximum savings.

Mission Accomplished!

Your UK Accounting Empire is Active. Now You Have Access To:

Choose Your Protection Level

All plans include dedicated UK accountant, HMRC compliance, and unlimited support

Starter Shield

Perfect for new businesses testing UK market

Features

Growth Fortress

Complete protection for scaling businesses

Features

Elite Protection

Maximum security for high-growth businesses

Features

Meet Your UK Accounting Specialists

Expert accountants with deep HMRC knowledge and insider tax optimization strategies

MuteTaxes Expert Team

UK Chartered Accountants & Tax Specialists

Our team of ACCA and ICAEW qualified accountants specialize in helping UK businesses navigate complex tax regulations, maximize reliefs, and maintain bulletproof HMRC compliance.

UK Tax Expertise

UK Entities Managed

Tax Savings Generated

Our Clients Come First, Always

We take pride when our clients become our friends

"MuteTaxes saved us £32,000 in R&D tax credits we didn't even know existed. The team is incredibly responsive and their tax planning advice has been invaluable for our growth strategy."

Mikaela Anasya

Founder MarketSavy

"After years of DIY accounting stress and HMRC warnings, MuteTaxes cleaned everything up in weeks. They handle all our compliance now and I can actually sleep at night. Worth every penny."

Nicholas Jono

Founder TeamTalk

"The financial dashboard gives us real-time visibility we never had. We can make smart decisions backed by actual data instead of guessing. Game changer for our e-commerce business."

Niana Joana

Founder Selfast

"MuteTaxes saved us £32,000 in R&D tax credits we didn't even know existed. The team is incredibly responsive and their tax planning advice has been invaluable for our growth strategy."

Mikaela Anasya

Founder MarketSavy

"After years of DIY accounting stress and HMRC warnings, MuteTaxes cleaned everything up in weeks. They handle all our compliance now and I can actually sleep at night. Worth every penny."

Nicholas Jono

Founder TeamTalk

"The financial dashboard gives us real-time visibility we never had. We can make smart decisions backed by actual data instead of guessing. Game changer for our e-commerce business."

Niana Joana

Founder Selfast

"MuteTaxes saved us £32,000 in R&D tax credits we didn't even know existed. The team is incredibly responsive and their tax planning advice has been invaluable for our growth strategy."

Mikaela Anasya

Founder MarketSavy

"After years of DIY accounting stress and HMRC warnings, MuteTaxes cleaned everything up in weeks. They handle all our compliance now and I can actually sleep at night. Worth every penny."

Nicholas Jono

Founder TeamTalk

"The financial dashboard gives us real-time visibility we never had. We can make smart decisions backed by actual data instead of guessing. Game changer for our e-commerce business."

Niana Joana

Founder Selfast

Frequently Asked Questions

Everything you need to know about UK accounting with MuteTaxes

Our comprehensive service includes company formation, monthly bookkeeping, VAT returns, Corporation Tax filings, Self Assessment, payroll management, year-end accounts, Companies House compliance, HMRC correspondence, tax planning, financial dashboards, and unlimited support from your dedicated UK-based accountant team.